Various Projects

PACECAR

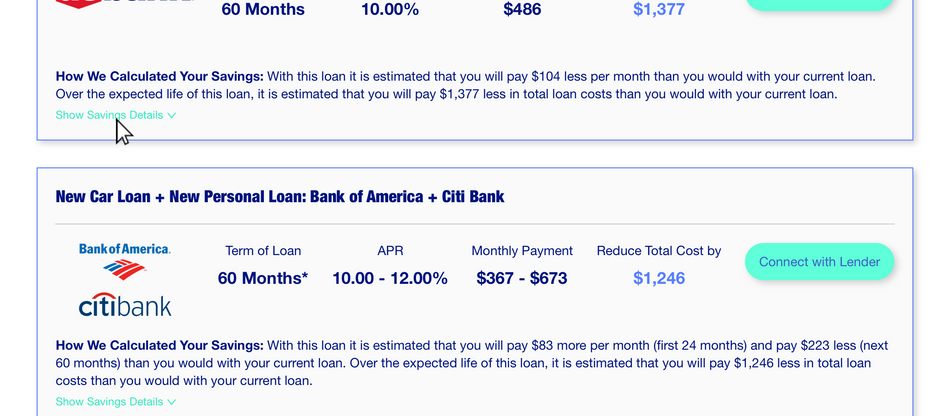

Pacecar partners with auto lenders and insurance carriers to provide customers with multiple offers, helping them find the best deals in one convenient platform.

Objective

Create a seamless, user-friendly experience that simplifies the process of comparing auto financing and insurance offers, helping users quickly find the best deals while reducing friction and improving conversion rates.

Common Challenges

-

Users struggle with uploading personal and vehicle information (e.g., name, DOB, VIN).

-

The highest drop in conversions occurs when users are asked to provide their SSN for a credit check.

-

Conversion rates significantly decline during the hand-off to lenders at the end of the process.

-

Users dislike receiving numerous calls or emails after submitting their contact information for auto-refinancing.

User Goals

-

Easily upload personal and vehicle information with minimal effort.

-

Complete the credit check process quickly and securely without unnecessary steps.

-

Transition smoothly to lenders at the end of the process without confusion or delays.

-

Receive relevant, timely communication without being overwhelmed by calls or emails.

Business Goals

-

Increase conversion rates by streamlining the data entry and credit check process.

-

Improve user experience to reduce friction during the transition to lenders.

-

Minimize drop-offs by enhancing the communication process and reducing unwanted follow-ups.

-

Build trust and satisfaction to encourage repeat business and positive referrals.